Description

ABOUT THE BOOK

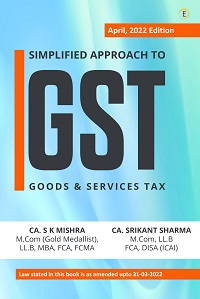

Most up-to-date and comprehensive book on GST. Law stated is updated till 31-03-2022.

The book has been designed on “self learning” technique.

Large No. of examples with practical problems incorporated.

Each Chapter starts with Statutory provision followed by Analytical discussion.

Theoretical discussion is suitably supplemented by problems/ illustrations.

Composition scheme, RCM provision, Exemptions, Input Tax credit (ITC) , Time & value of supply, E Invoice, E way bill elaborately discussed.

ABOUT THE AUTHOR

CA. S K Mishra is a Fellow member of The Institute of Chartered Accountants of India, New Delhi & Fellow Member of The Institute of Cost Accountants of India, Kolkata. He is a post graduate in Commerce from Sambalpur University, Odisha and also holds Bachelor degree in Law (LL.B). He was awarded the University Gold Medal for securing 1st position in 1st class in M.Com. He also holds Master degree in Business Administration (MBA) besides having completed several other degrees/diploma & certificate courses. He has more than two decades of experience in industry having worked in various field of finance & specializes in direct & indirect taxes. He carries commendable knowledge and has proven track record in handling complex Indirect Taxes and GST matters. He has addressed large no of workshops & seminars on GST. He has been an active blogger for past many years & regularly contributes articles in electronic/ print media & professional journals, which is well appreciated by readers. The author has contributed extensively in the field of Indirect taxes & GST in particular, in various seminars/workshop /conferences & social media. His book titled “Systematic Approach to GST”, “Indirect Tax Laws”, “Simplified Approach to GST” & “Students’ Guide to GST” have received overwhelmed response from students’ & professionals.

CA. SRIKANT SHARMA is a Fellow member of The Institute of Chartered Accountants of India (ICAI). He has completed graduation & post-graduation in Commerce from Sambalpur University, Odisha and also holds Bachelor degree in Law (LL.B). He has also completed Diploma in Information System Audit (DISA)) & certificate course on “Concurrent Audit of Banks” from ICAI. He has been associated with EIRC of ICAI in various capacities, such as in Research Committee & Career Counseling Committee. He has more than a decade of experience in professional practice and specializes in the field of direct & indirect taxation. He has addressed large number of seminars/workshops in the field of direct & indirect taxes. He has also been teaching GST to students at various levels since the Act has been enacted.

Reviews

There are no reviews yet.