Description

About the book

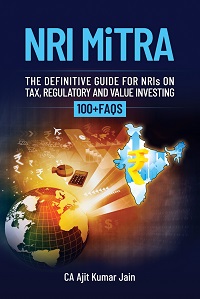

If you are an NRI and looking out for a comprehensive resource for all your tax, regulatory and investment-related matters, you are at the right place.

“NRI MiTRA” is a source of guidance on the Indian tax and regulatory provisions applicable to the NRIs and various investment opportunities in India. With more than 100 practical examples and FAQs, investors/taxpayers would find an easy way to learn all the provisions and solutions to related issues. This book discussed each of the topics very lucidly so that NRIs from any background can easily understand the concepts. This book focused on how NRI can create wealth in India by timely investing in the right opportunities. This book mainly covers the following:

- Residential Status

- Taxability of NRIs

- Capital Gain tax

- Different Bank accounts, Gifts, and Inheritance

- Immovable property, Remittance, and repatriation of money

- Recently migrated NRIs, returning NRIs

- Tax planning strategies

- Lending and borrowing

- Annual information statement, PAN card, and Aadhar Card

- Various investment opportunities in India

- Value investing, Fundamental analysis

- Cryptocurrency and Non-Fungible Token (NFT)

- Frequently Asked Questions (FAQs)

About the author

Ajit Jain is a Chartered Accountant and Company Secretary. Ajit has over ten years of experience (in India and abroad) in international taxation, transfer pricing, and NRI Taxation. Ajit has contributed more than twenty articles/research papers on Taxation, and he is also a regular speaker on various topics related to taxation and investments. Ajit was awarded the ICAI International Research Paper award in 2020 under the taxation category.

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.